What are the benefits of employee vehicle leasing?

By SG Fleet | 31 March 2022

.jpg)

One of the most significant challenges for companies following the global pandemic has been attracting new employees. In uncertain times, people simply aren’t sold on the idea of taking a chance on moving somewhere new.

If your company is in that boat, one of the best tools in your arsenal might be to get creative with your benefits package.

While those benefits can be wide and varied – ranging from employees buying and selling holiday days, to helping them purchase the latest gadgets – the one we’re primed to offer advice on here at SG Fleet is an employee car benefit.

Read on to learn about the pros and cons of employee vehicle leasing and discover which option might be right for your people.

Employee car benefits explained

There are several different kinds of car benefits employers typically offer to employees.

Company car scheme and car allowance

A company car is a vehicle typically provided to an employee as a condition of their employment. It’s either owned outright by the company or leased by them. If used outside of work as a personal vehicle (as is most often the case), the employee using the vehicle will have to pay Benefit in Kind (BiK) tax. The specific amount depends on several factors, like the value of the vehicle and the fuel it uses.

If a company leases a company car, they may choose to pay the employee the cost of the lease each month, and have the employee take out the lease directly. This is called a car allowance, and it is not subject to BiK tax.

The pros and cons of these two methods are much the same.

- Pros: As mentioned at the start of the article, a company car can be an excellent incentive for employees considering joining your company in these uncertain times. It can even aid employee performance, giving them a way to get from A to B quickly. And if your company owns the car, it can also be a great opportunity to add company branding to the vehicle, turning it into a mobile advertisement for your business.

- Cons: Purchasing company cars is expensive, both in terms of initial outlay as well as in terms of tax, insurance and servicing. This is why many businesses turn to the leasing model. However, either way, the expense sits within your business – not a problem associated with the other car benefits below. Notably, a company car also increases your company’s accident liability, meaning your insurance premiums could go up significantly – especially if one of them has an accident while driving a company vehicle.

Salary sacrifice car benefit

Salary sacrifice deducts the cost of a benefit from an employee’s pay before tax and National Insurance deductions. The benefits of employee vehicle leasing done this way are that they can often make significant tax and NI savings. For that reason, it’s by far the most popular form of employee car benefit and something we offer two different options for here at SG Fleet.

Car Salary Exchange is our traditional salary sacrifice offering tax and NI savings alongside discounts unlocked through our corporate buying power. You can also choose your lease term, allowing you full flexibility over the length of the lease.

However, another significant benefit of employee vehicle leasing in this manner is the host of extra benefits it offers to both companies and their employees. These include:

- Servicing, maintenance and tyres

- Accident management

- Roadside assistance

- Cover for unforeseen events

- And comprehensive insurance

Novalease can be thought of as a partial salary sacrifice benefit. The option for salary sacrifice is available on some cars in the range, and carries the same extra benefits as the Car Salary Exchange option above.

However, one huge benefit of employee vehicle leasing via Novalease is that the lease contract is not between your company and the leasing partner, but between the partner and the employee themselves. That means the arrangement is entirely de-risked for your business, with the employee liable for any possible early termination fees.

Direct hire contract

Another less widely used, but still effective way of offering an employee car benefit is to facilitate setting up a direct hire contract directly between an approved corporate leasing partner, and your employees.

At SG Fleet, we offer a version called Personal Contract Hire (PCH). It provides many of the same benefits as Novalease like servicing, licensing, accident management and roadside assistance – albeit without the option for salary sacrifice and its associated tax and NI savings.

PCH arrangements start with an initial rental period of one, three, six, nine or twelve months. The benefits of employee vehicle leasing in this manner are that it carries no BiK cost, presents zero early termination risk for the employer, and is extremely quick to implement, with no ongoing administration. It’s also available to all employees, whereas certain exclusions can apply for the other car benefit options mentioned above.

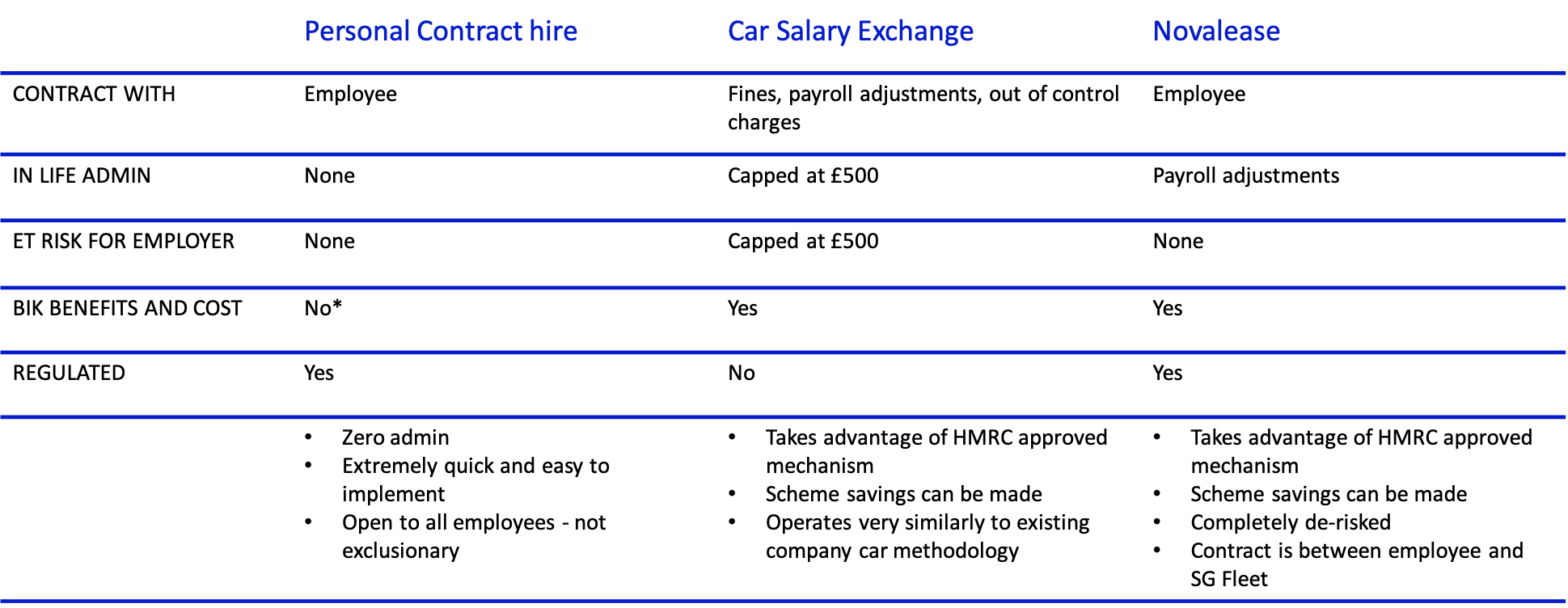

Our employee leasing offering at a glance

Not sure which employee car benefit is right for your company? Use this handy table to see the pros and cons of employee vehicle leasing via each option.

So, is employee vehicle leasing a good idea?

As our fly through the pros and cons of employee vehicle leasing has established, employee vehicle leasing is a great way to attract would-be new starters as part of a comprehensive benefits package. It’s also an excellent alternative to typical company car schemes, and offers several different options to suit businesses of different types and sizes.

To learn more, visit our employee or employer pages for our vehicle leasing options. Alternatively, call us on 0344 854 5100 or email CSalmon@sgfleet.com.

.png)

.png)

.png)

.png)